Kymera Labs

117% of funding target

Highlights

Highlights

A breakthrough solution for the global data market

Existing methods used in data protection today do not provide a suitable solution, since they allow for the recovery of customer data, and might expose users' identity. The groundbreaking technology developed by Kymera, based on a mathematical model, allows creating "Fake Data", a database of "fake" info, which is based on the real data without the risk of privacy loss. Unlike existing solutions, with this tech, it is not possible to retrace data or expose any real information.

Chosen startup by Citi Bank and First International Bank of Israel Accelerators

Today, Kymera operates within the frame of 2 exclusive financial accelerator programs, held by The First International Bank of Israel and Citi Bank in Tel Aviv, two leading banks which have shown great faith in Kymera’s tech and product, and are interested in creating a long lasting technological cooperation, in which the company’s tech will be implemented in various banking units.

Investments by Peregrine Ventures, the Israeli Innovation Authority and leading “angels”

As of November 2018, Kymera takes part in the “Technological Greenhouse” ("חממות טכנולוגיות") program, within Peregrine Ventures’ incentive greenhouse, in collaboration with the Israeli Innovation Authority. In addition, the company's investors so far include "angels", with extensive experience and a record of supporting some of the largest companies in the Israeli economy, including Waze, MobilEye and others, who have noticed the great potential of Kymera’s tech, and have chosen to join its success.

|

|

|

Unique patent-protected technology (pending)

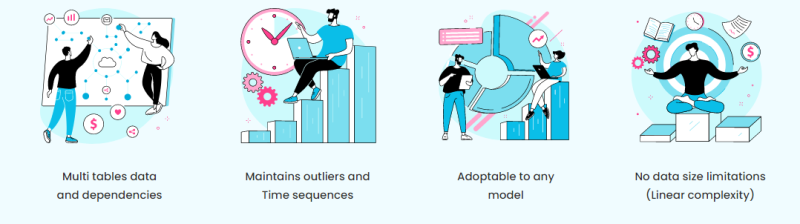

Kymera's technology is based on patented mathematical developments, which are in registration processes (PROVISIONAL) worldwide, and represent a valuable and highly attractive intellectual property. In an increasingly data-driven world, the company's unique IP enables its customers to make full use of all features and data contexts, simulate many types of data, exceptional processing speeds, and real reference to end cases and "irregular" data which has so far "disappeared" due to regulation demands. Combined with the ability to also record events on a chronological timeline, Kymera enables a groundbreaking, far more accurate use and analysis of data than ever before, for various needs including machine learning, complex statistics, quality assurance and more.

Start of production, following successful pilots

In January 2021, Kymera will go into production as part of its cooperation with The First International Bank of Israel, to create synthetic data in order to meet new regulations led by the Bank of Israel, after successful pilots carried out with various international banks and leading financial companies.

The company is also in various stages of negotiation with a large pool of other companies, including international banks, large corporations, Israeli banks, fintech and financial companies, systems integrators and others, who are all interested in acquiring Kymera’s tech.

|

|

|

Pitch

Pitch

The Need

In today's tech world, it is commonly said that “if you don’t pay for the product - you are the product”, a phrase which mostly refers to the large amounts of data, generated by users on various platforms. In fact, today, user databases are now considered the "new oil" - a valuable resource, whose importance and value have only increased in recent years, and are expected to keep rising in the near future.

The global economy, which is more affected than ever by high tech and is heavily driven by data, is in an ever-increasing need for more advanced tools for transmitting, sharing, and processing data, including "transporting" data to different locations inside and outside the organization, sharing data with third parties, processing data on various platforms, etc - all this, while having to meet strict requirements in order to maintain privacy, and protect sensitive data.

The fields of Machine Learning (ML) and Artificial Intelligence (AI), which are growing rapidly in recent years, require great amounts of high-quality data, but this information tends to be sensitive in nature, as it is gathered by private users. ML and AI are very common in a variety of industries, including fintech, healthcare, and more, and are expected by analysts to grow significantly, in the next decade.

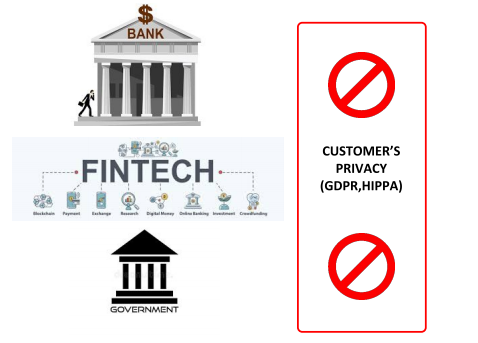

Today, the main challenge in obtaining quality data in sufficiently large quantities is the fact that these databases contain a high amount of "sensitive" data elements regarding users, which may be cross-identified with additional information. This fact has led regulators around the world to adopt strict regulatory measures, regarding the security and privacy of data (Including GDPR, HIPPA, PCI, etc).

The Regulatory “Bottleneck”

This regulation restricts access to data and sets clear rules for data transmission, while also significantly limiting the types of data that can be used or shared. These limitations affect many industries that rely on data, but are particularly crucial in industries that deal with more sensitive data (Privacy, Confidentiality), such as financial data (Fintech), security data, medical information and more.

This is why the data currently transmitted is in many cases partial ("masked"), for the purpose of complying with regulations, but also impairing the ability to analyze and draw conclusions based on this data. In the "masking" process, "features" of the original data are often damaged, and so it becomes difficult to use it for training set applications, for machine learning processes. In fact, the long duration of time required to obtain approvals for data transfers, which may reach many months of waiting, is by itself a significant barrier for companies operating in this competitive field.

The Solution

Kymera Labs has developed a platform for synthesizing data - creating “Fake” databases - based on innovative technology, protected by a unique patent (PROVISIONAL). This technology actually allows customers to accurately mimic their real data - without risking any loss of privacy and data confidentiality.

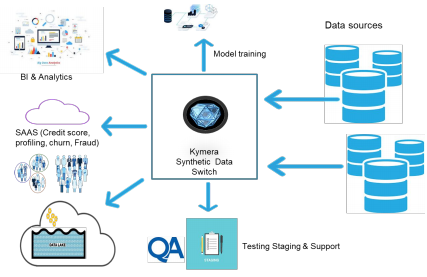

Kymera's synthesis platform operates on a SAAS ON PREM model, and is installed in the customer's systems, on which it produces synthetic data, which mimics all the qualities and statistical features of the original data, while eliminating any possible security risk.

The Kymera system enjoys significant and critical advantages over competitors, in terms of the ease of use of the platform, its installation process, the required computing power and of course the array of statistical features and irregular data handling capabilities, which are maintained in full.

|

|

|

|

Technology

Kymera’s groundbreaking technology is based on an exclusive mathematical model, which is patent protected (provisional) by the company. Compared to existing technologies in the synthetic data market, which are based on AI models, including GAN technologies which are limited in terms of long processing times, and the complexity of data processing and problems in maintaining statistical features, Kymera's data technology is the first and only method in the world, based on mathematical theories. This fact gives it the ability to preserve events over real timelines, maintain irregular data items etc, while allowing the synthesis process to be performed at short time constants, while maintaining linear complexity.

Possible uses of Kymera’s tech:

|

|

Insights and Analytics: The ability to analyze data directly, without the prior need to encrypt or perform masking and anonymization processes. |

|

|

System QA testing: Improving the level of accuracy for quality testing results - which also allows shortening the development times needed for complex processes. |

|

|

Cloud services: Advancing to synthetic data makes the use of cloud services, which so so far were inaccessible to those with sensitive data, finally possible - without compromising the level of safety, and complying with all regulatory requirements. |

|

|

AI and ML models: Kymera's synthetic data enjoys exceptionally high quality, due to its ability to preserve all the statistical features of the original data while being able to replicate it and improve the "learning" process for AI and ML models. |

|

|

Customer Scoring: Kymera Labs allows using synthetic data to gain results and conclusions, that can later be applied to the original data. This way, organizations can freely use third-party sources for analytics, without risking any disclosure of the original sensitive information |

Team

Team

|

Software engineer, and entrepreneur with 20 years of experience in establishing and managing companies, business development, and building international distribution and sales channels. With extensive experience in managing teams and tech companies as well as data analysis systems, he brings with him relevant knowledge and experience on both the technological-product side and the business side. Entrepreneur and co-CEO of a petrol and related control systems company; he has also served as director for a Chinese investment company.

|

|

Software engineer, with over 16 years of experience of working in start-ups especially in the fintech industry, SaaS projects and cyber-security.

Vast experience in end-to-end system development.

Specializes in building complex server side solutions from the initial design to a finished, polished scalable product, with passion about new technologies.

|

|

Graduate of the IDF’s “Schakim” Program and product manager in Unit 8200, with product experience at the VMware company. An economist with an MA and over 7 years of experience in government financial institutes - data analysis in the markets division of the Bank of Israel; A senior coordinator in charge of security and intellectual property systems, at the Accountant General’s office in the Ministry of Finance. Noa brings to the project a combination of experience in product management with extensive relevant experience in working on sensitive financial data analysis, and is deeply familiar with the financial players in the field.

|

|

Software engineer and data scientist, with 20 years of experience in machine learning platform development, complex backend software systems architecture and development leadership. Extensive experience in the design and implementation of machine learning platforms, big data data architectures, and machine learning algorithms - clustering, prediction models, etc. Gilad‘s extensive experience in the field is highly relevant to the project, building Kymera’s solution and architecture as a holistic and robust platform.

|

|

Eleazar Edelman is a well-known American engineer, scientist and cardiologist. He is a professor of medical engineering and science at the Massachusetts Institute of Technology (MIT), a professor of medicine at Harvard Medical School and at Brigham and Women‘s Hospital in Boston, as well as a cardiologist at BWH.

|

|

Mathematician, software engineer, investment manager and board member of several biotech companies, with experience in the fields of venture capital, investment banking and business development in high-tech and biotech companies, with an extensive scientific background.

|