Mada Analytics

Leading to a world of renewable energy

75% of funding target

Highlights

Highlights

An advanced AI platform designed to boost investments in renewable energy

The renewable energy market is crucial to today's global population more than ever, but renewable energies are still considered unreliable, due to their dependency on seasonal and weather conditions. This is why funding entities such as banks tend to view these ventures as high risk, making it harder for them to receive optimal conditions for investment and project financing. In order to uproot this major obstacle, MADA Analytics' groundbreaking AI platform creates accurate simulations and financial forecasts for energy companies, helping them reduce the risks involved in large-scale renewable energy projects and ultimately making investing in such projects much safer more cost-effective. These models allow for precise insurance adjustments to ensure cash flows, as well as streamline the design of energy storage systems in order to provide the ultimate financial results, and improve financing and investment conditions - while removing significant barriers to the development of the entire industry.

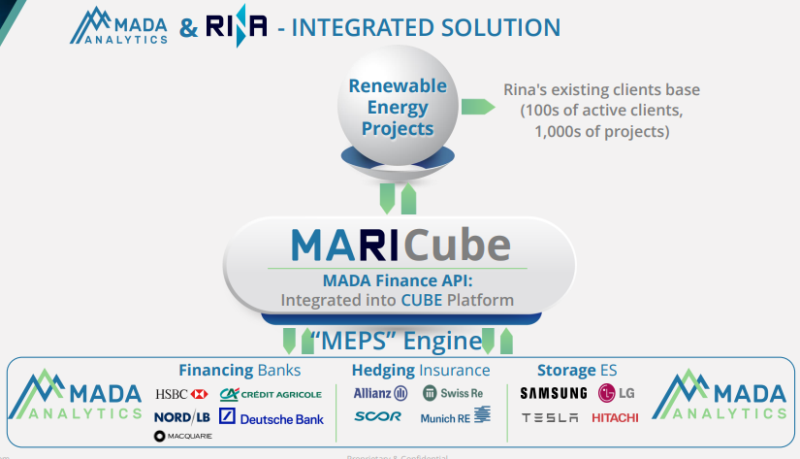

Ongoing commercial and R&D collaboration with the international RINA Company, allowing immediate global market access

MADA Analytics is developing its system in cooperation with RINA - an industry-leading global company, specializing in providing engineering and financial advice to renewable energy projects. As part of this collaboration, RINA will provide actual, updated wind data from its existing projects, and will also develop a complementary system to MADA's, at the same time. Later on, these two systems will be integrated into a singular platform (MARICube), which will be marketed to RINA's large customer base in Europe and around the world.

Investments made by the Israeli Innovation Authority and leading international investors

So far, the company has received investments and grants from a long list of leading entities in the fields of innovation, energy, and finance, both in Israel and worldwide, including The Israeli Innovation Authority, TechStars Impact Accelerator with Morgan Stanley, DigiMax Global, Barclays, Eureka Innovation, Cyberport, NBIF, Schneider Electric, Artesian Venture Partners and others.

|

|

Successful pilots and signed agreements with energy companies and global partners

In addition to its main commercial and research collaboration agreement with RINA, MADA Analytics has successfully completed a number of POC and customer validation pilots with companies around the world, such as Schneider Electric in California, Vesta in Chile, Cross-boundary in Kenya, Capital Energy in Spain, and Doral Energy in Israel, among others.

Founders with vast experience in the global energy and financing sectors

MADA Analytics is led by a team of managers and founders who are all well-versed and have all the needed experience required to develop such a platform, and lead a successful collaborative project with a global corporation: CEO Danny Gimpel has many years of experience in the energy industry (MADA Energie) and in management at the Tamir Fishman Investment Fund. Arie Adi as Tech Lead software engineer has deep expertise in machine learning and as a full stack developer comes with over 20 years of experience in development, integration, and support for Tier 1 companies (including Mobileye, Intel and Cisco, and AT&T Labs), Yossi Fisher, MADA's R&D manager, is an expert in Data Analytics and the director of Energy Solaris, who has registered 10 control and optimization patents with his partners, and Eric Salmon, Director of Financial Applications, brings over 25 years of his experience on Wall Street, as well as degrees from the prestigious Stanford and Harvard universities, and a reputation as a leading expert in the US renewable energy market. In addition, the company enjoys the continued support of an experienced and world-renowned advisory board.

Pitch

Pitch

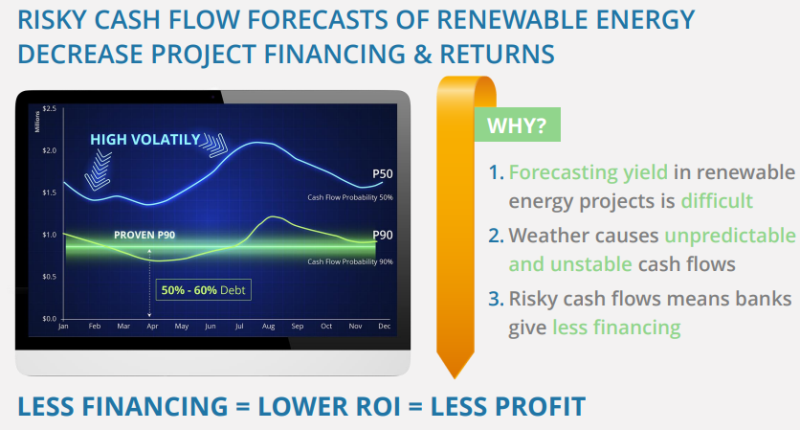

The global energy market relies in the last decade on green/renewable energy sources more than ever, but according to the latest report by the International Energy Agency, the global capacity to actually generate such energy is still developing too slowly and is not able to provide the required energy volumes, in order to successfully meet the global goal: production of 50% of all electricity by sustainable means of production, by the year 2030.

In this report, the agency emphasizes the importance of integrating diverse renewable energy (VRE) technologies, including wind and solar systems, as they are crucial in order to reduce the carbon emission caused by the energy market while meeting the growing global demand for energy. The agency sees VRE tech as an essential and economically viable tool for this purpose, but in order, for it to become a major means of energy production. The report mentions that substantial reforms are needed, to improve and enable long-term planning and design of these systems (as opposed to real-time field activity only). Along with a need for means to allow systems flexibility with accurate financial analysis planning, a critical tool for investors and banks as well, is needed to predict economic performance, and allow improved financing conditions.

One of the major challenges facing renewable energy projects is their inherent dependency on weather conditions, which are not fully controllable or predictable - and of course present a challenge for investors, who cannot rely on stable financial forecasts when entering this market. Another related issue is the tendency of banks to view these ventures as potentially higher risk and accordingly - making it more difficult for projects to be granted better funding conditions. Another deep need arises from the lack of dedicated analytics and management tools, which will enable active management performance and reduce inactive times, lowering maintenance costs and extending the duration of use of facilities.

These statements by the IEA are supported by industry leaders and global financial institutions, all confirming the agency's forecasts and emphasizing the deep need for improved analytical tools, including financial and production forecasts to enable the field of renewable energy systems to reach its full potential, both in terms of energy production volume and meeting the targets for global sustainable energy production, as well as in terms of the investments made in the field, which of course determine its pace and scope of growth.

The Solution

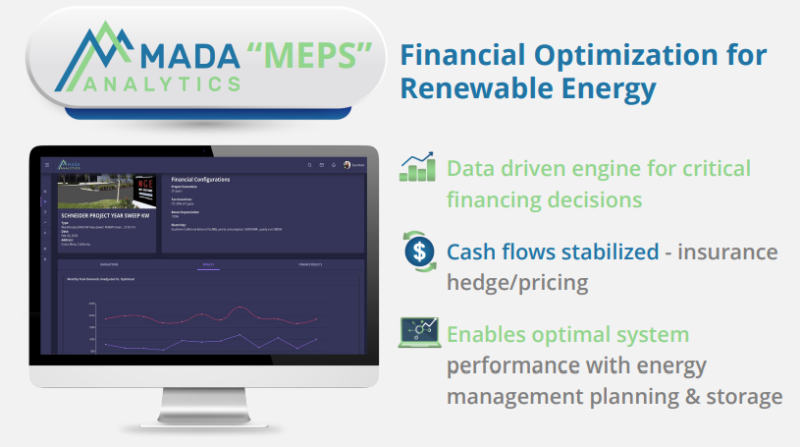

To meet this crucial need, MADA Analytics harnesses its analytical capabilities and many years of experience in the fields of renewable energy and financing, in order to develop an artificial intelligence-based system - MEPS - which offers companies optimal strategic planning tools for renewable energy production, while maximizing the financial aspects of such projects.

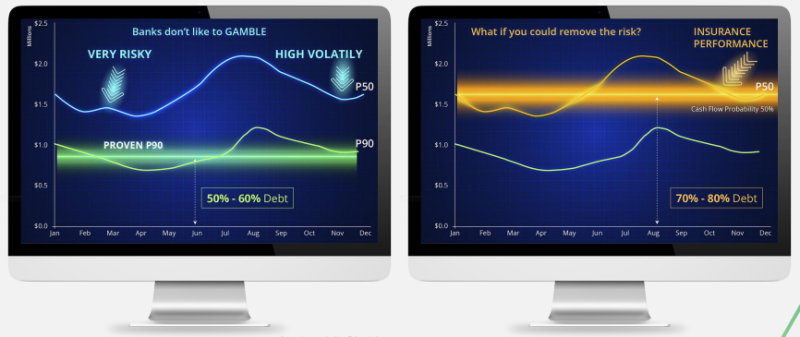

MADA's groundbreaking AI technology solves this deep need by providing a first-of-its-kind platform for accurate financial forecasts, with profit maximization capabilities, minimizing the risks involved in renewable energy projects, adjusting insurance accurately to ensure cash flows, and streamlining energy storage systems.

The system developed by the company will maximize from the early project planning stages, all financial aspects, risk management, pricing, etc. - to ensure the best financial results and economic forecasts, which are currently impossible to produce with existing tools available in this market. The company's technology will enable the planning of all operational aspects and their implementation under AI-based algorithms, with the ultimate goal of meeting financial targets, and not just "blindly" producing energy, as currently done.

Utilizing MEPS will enable companies and projects to optimally plan their venture in terms of financial structure, and provide CFOs with tools for comparison and evaluation, along with monitoring and reporting systems with real-time field data, operational recommendations, storage, and analysis.

Among other things, the system will enable companies and projects to optimally plan their venture in terms of financial structure, provide CFOs with tools for comparison and evaluation, along with monitoring and reporting systems with real-time field data, operational recommendations, storage, and analysis for all relevant big data and more.

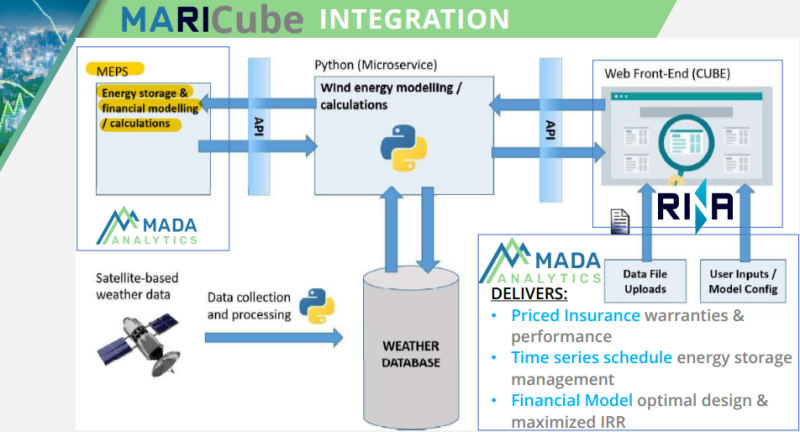

Technology

MADA's MEPS platform is based on AI and analyzes data from millions of simulations of renewable energy projects (REP) which it creates, in order to gain statistical insights that are fed into the MEPS AI system, in order to generate an output of optimal solutions for each and every project.

Once the system has finished analyzing the project and the financial parameters of critical impact, it provides an optimal design and execution plan, focuses on and identifies the optimal scenario based on the existing analyzed data, to maximize financial profits as much as possible.

The MEPS platform will provide users with various recommendations, including:

- Optimal system configuration in terms of capacity, size and duration of operation of the power storage system

- Optimal financial pricing in order to meet financial goals

- Optimal timing and schedule for energy storage throughout a year of operation

- Optimal financial model for each project (debt/equity balance) and more

- Detailed simulation of energy production and corresponding accurate financial insurance solutions

- Streamlined project financing integration

- Optimal AI-based operational and investment planning for the highest returns and lowest risk, based on accurate cash flow data and planned energy storage systems data

The platform's technological tools include, among others:

- AI optimization tool based on MIMO models (multi inputs - multi outputs) for optimizing the volume of activity and financing, based on real data

- AI simulator based on the company's IP - deep dynamic processing algorithm

- Decision support system (DSS)

- A monitoring and reporting mechanism to allow all stakeholders to compare forecasts with actual performance

- A tool for developing new or existing hybrid projects - shortening planning and execution timelines

MADA's technology is developed in complete and tight-knit cooperation with the UK branch of RINA - an international company that specializes in providing engineering and financial consulting for renewable energy projects around the world. As part of this collaboration, MADA will receive real, up-to-date wind data from existing projects supported by RINA, from the system called Wind Optimum, designed for classifying and processing operational data from wind-based projects for future performance forecasts, in parallel to the MEPS system developed by MADA.

The companies are working towards integrating the two systems into a combined platform (MARICube) that will be marketed to RINA's customers in the UK and around the world.

Intellectual Property

MADA Analytics will maintain ownership of all IP related to its MEPS software development, including its simulation and optimization algorithms, while RINA will maintain ownership of the performance data and IP pertaining to its RINACube and Optimum Wind platforms.

Regarding ownership of the MARICube IP, the signed Commercial Collaboration agreement between the parties defines that the results jointly achieved by both parties will be co-owned by the parties. The full ownership and related rights will be assigned as a percentage relative to the contribution respectively provided by each party. MADA will pay royalties to IIA from the sales of MEPS in the framework of MARICube's commercialization. MADA's subcontractors will not own any of the IP developed for this project.

Team

Team

|

Has extensive experience in the fields of energy, including serving as CFO of MADA Energie and working in financial institutions, including 7 years as director at the Tamir Fishman Investment Fund. In addition, Daniel has deep fin-tech experience as the head of international sales for the fin-tech software company E4X Inc (Border Free), which developed solutions of foreign exchange hedging for ecommerce international merchants. He has an M.B.A. in finance from Johns Hopkins University and completed his B.A. in Philosophy and Ethics after attending New York University and Emory University.

|

|

Arie has an extensive career in technology and software development spanning 25 years. His previous work for Mobileye and Intel focused on integrating "machine learning" features into an automated regression testing validation system. His extensive experience in end-to-end integration of complex projects has served him well in providing critical support to Intel, Cisco, and AT&T Tier 1 customers. Initially, he served as a Level 3 support leader for packet data business networks, and then progressed to real-time software development in Unix for AT&T-WorldNet‘s business web service. He holds a BS in engineering specializing in mechanical engineering from Temple University. As Chief Engineer for AT&T Labs, he has taken courses from the MS program for over two years, at Columbia University School of Engineering and Applied Science, specializing in machine learning.

|

|

An expert in the field of analytics data, in which he has gained experience in software solutions for optimization in the semiconductor industry. Yossi has registered over 10 control and optimization patents, he has extensive practical knowledge in the design and management of renewable energy systems, and has served as the manager of the Energy Solaris company. He holds an MA in Physics and Mathematics from the Hebrew University.

|

|

An expert with extensive knowledge and experience in the financial and operational aspects of the energy market in general, and the renewable energy market in particular. He has served as an energy expert on Wall Street for over 25 years, and has gained a reputation as an expert in the US renewable energy market. Eric holds a degree in energy engineering from Stanford University BS & MA, and then completed his law degree from Harvard University.

|

|

In his role as chairman of the company‘s advisory board, Yossi will focus on developing economic models in the field of insurance and risk management.

|