ExitValley

Become a shareholder in the successful investment platform in Israel

266% of funding target

Highlights

Highlights

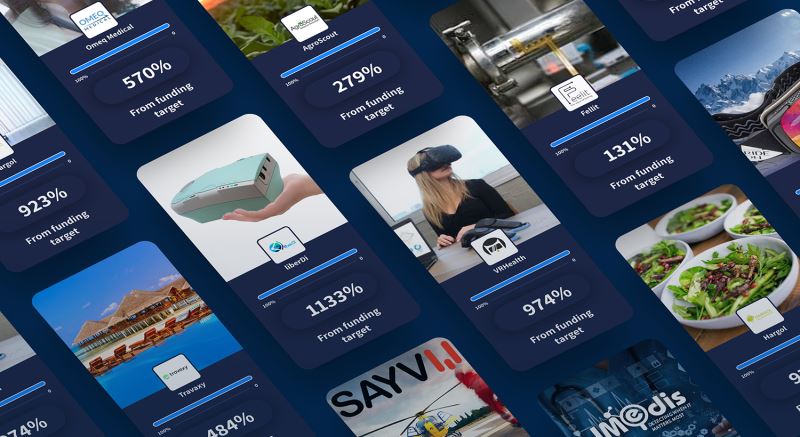

The First and Most Successful Investment Platform in Israel

ExitValley continues to break records and lead the market with: the highest number of successful campaigns, the highest amount of funds raised, the largest investor community in Israel.

.png)

The information is available in the campaign's financial section, to authorized investors only.

ExitValley is Showing Unprecedented Growth – Now is the Time to Join

In just two years, ExitValley has shown accelerated growth in its operations, which is reflected in all areas:

- Increase in the number of investors

- Increase in company revenue

- Increase in the amount of money raised

- Increase in the number of successful campaigns

- Increase in the average amount raised per campaign

The information is available in the campaign's financial section, to authorized investors only.

A Winning Business Model that Works Well

ExitValley's business model is based on a large number of revenue channels that combine one-time revenue with long-term revenue. ExitValley has also developed a number of related and profitable sources that increase its revenue.

The information is available in the campaign's financial section, to authorized investors only.

The Main Growth Engines are Already Here - ExitValley is Expanding its Operations

Having established ExitValley as the leading and fastest-growing investment platform in Israel, we are in the midst of expanding our operations into even larger markets:

Real Estate – ExitValley’s expansion into the real estate business is meeting with great success. This venture is gaining momentum and the company anticipates successful campaigns for the coming year.

Small Business - We have decided to take our startup fundraising model to the small and medium business world, which accounts for over 90% of the Israeli business market. A number of small businesses are already preparing to start their fundraising campaigns through the ExitValley platform in the coming weeks.

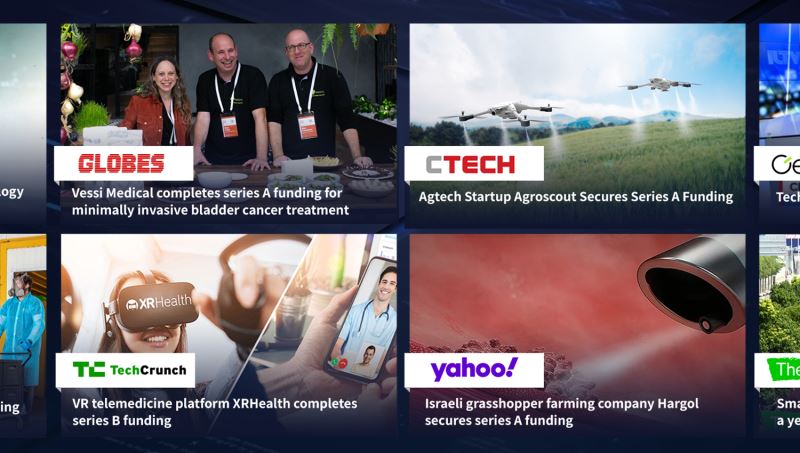

The best companies choose to fundraise through ExitValley

ExitValley is committed to bringing our community the most attractive investment opportunities in the top Israeli tech companies. In the past month alone, six of our portfolio companies have completed advanced fundraising rounds and thus joining our many portfolio companies that have already completed advanced rounds from leading VCs and private investors.

Strategic collaborations with leading Israeli investment, media, and technology entities

ExitValley has established an extensive network of strategic collaborations with the largest and most important investment and technology bodies in the country, from the Israeli Innovation Authority to Incubators, Angels and VCs, such as: Trendlines Incubator, NGT Incubator, Rimonim Venture Fund, Sanara Ventures, and more. Recently, significant cooperation has begun with the largest economic news site in Israel - Calcalist.

.png)

Pitch

Pitch

Over the past 5 years, the Israeli investment market has undergone a complete face-change. Only a few years ago, the ordinary investor's ability to gain access to high-tech companies was very limited, and the idea of investing with a few clicks from your living room sounded quite far-fetched. Today, this is the reality, and it is accelerating rapidly. As establishers of the start-up Internet investment sector in Israel, we are experiencing first-hand the spurt in growth of the new investment world we have created. The market has grown in unprecedented fashion, the number of investors has surged exponentially, and more entrepreneurs are opting to fundraise in this way.

Now, in the midst of this accelerated growth, and as we move towards our Growth Stage, we have chosen to do our Round A funding through our own platform, and invite you to invest in us, become a shareholder and be part of the most successful and advanced investment platform in the Startup Nation.

What we have done in the last two years:

1. We have opened up the Israeli financial market

Established by the founders of the Internet investment industry in Israel, ExitValley is the only platform that has developed a comprehensive investment solution that allows the public to invest in Israeli technology companies and business ventures. ExitValley has developed an advanced investment mechanism that provides the investor community with an overall solution – from finding attractive investment opportunities, through the diversification of risk and regulating the terms of the transaction, to receiving ongoing reports regarding the advancement of the company in which you have invested. This was accomplished by the best possible team for the job - senior executives in the Israeli high-tech and investment industries, who have set up companies, launched IPOs, and sold companies in exit deals.

Our key achievement is the real change we have brought to the Israeli financial market. By creating a new channel that allows anyone to invest and be part of the Israeli high-tech industry success, while simultaneously opening up a new fundraising channel for entrepreneurs to help them build thriving companies, Exit Valley has effected a revolution in the world of finance and business.

2. We have shown exceptional achievements in all aspects of the company

To date, we are the market leaders, and currently, we hold an exceptional record of accomplishment, including:

- Establishing and institutionalizing the private investment industry in Israel (among other things, by spearheading the crowd investing legislation in Israel)

- Becoming one of the leading investment platforms in Israel in terms of fundraising volumes per year

- Establishing the largest investor community in Israel,

- The first Israeli Crowd IPO came through the EV platform - HeraMed launched an IPO on the Australian Stock Exchange, just six months after completing their ExitValley campaign, and provided their investors with excellent ROIs

- Leading the largest fundraising campaign in Israel ever - VRHealth

- We have significantly increased the average amount of funds raised per campaign, and are proud to be leading the market with many campaigns that have raised more than $ 1 million each.

- Our portfolio companies are successful and advanced; some have already completed advanced rounds of funding with significant increases in value.

The information is available in the campaign's financial section, to authorized investors only.

3. We have shown accelerated growth in all parameters

- Over the past two years, we have seen exceptional growth across all business parameters:

- Increase of listed investors

- Increase of growth in revenue

- Increase in the company's workforce

- Increase in money raised on the platform

- Increase in the number of successful campaigns

- Increase in the average amount of money raised per campaign

The information is available in the campaign's financial section, to authorized investors only.

4. We have developed an innovative set of tools for end-to-end investment and fundraising solutions

Advanced management tools for investors and companies

In order to support our growing number of campaigns and investors, we have developed some advanced tools to help the companies efficiently manage the campaign setup, fundraising activities, and closing stages:

- Investor Relations Management System - Just like the world's most advanced stock exchanges, we have developed an innovative tool that allows any entrepreneur who has completed a campaign on our platform to send updates to shareholders and hold votes quickly and efficiently. The system is currently being launched.

- A self-setup system - In recent months we have completed the development of a system that will allow entrepreneurs to create their own campaign pages quickly and independently, and will allow dozens of campaigns from different entrepreneurs to run simultaneously.

Creating new strategic partnerships

ExitValley and Calcalist – Israel's largest financial media site – have recently entered into a long-term collaboration. We have created an exclusive investment area on the Calcalist website, where you can view all the platform's investment opportunities. In addition, a content area contains various guides for investors and entrepreneurs. This increased exposure to the ExitValley brand has helped us expand the investor community, increase the number of entrepreneurial inquiries, and make great content available in the public investment world.

.png)

Case Studies:

Start-ups:

.png)

.png)

Expectations for the next two years

Having established ExitValley as the leading and fastest-growing investment platform for start-ups in Israel, our next step is to conquer even larger markets - including real estate, small business, and crowd investing - and become one of the world's leading platforms:

Real Estate - Following the successful launch in October 2019, we are expanding our real estate activity and anticipate successful campaigns over the coming year. The real estate market is one of the largest and most lucrative markets in the world.

Small Business - In Israel, as in most countries, small and medium-sized businesses account for over 90% of the economy. We intend to attain a significant volume of activity in the small business category, comparable to that of the UK fundraising platforms. A number of small businesses are already preparing to launch their fundraising campaigns through the ExitValley platform in the coming weeks.

Team

Team

|

Biography

Shahar founded the operation division of ExitValley. Shahar is an expert at managing online capital raising, from setting up a campaign, through campaign management to legal closing. Under Shahar‘s leadership and guidance, dozens of companies have raised over dozens of millions dollars through ExitValley, and most of these companies continue to grow and succeed. Now, Shahar is setting up ExitValley‘s "Rakaz Hatsa‘a" track, which will focus on fundraising for small and medium-sized businesses.

|

|

Biography

With a successful exit in his resume, Yaniv is one of the most experienced and accomplished managers in the Israeli financial market. Yaniv managed and significantly grew the options group in ‘Tamir Fishman investment house‘, which provides a range of financial services and products to companies and investors, and where he affected an impressive exit. Yaniv founded ExitValley, bringing with him a deep understanding of the financial market and a consolidated vision for the future. Now, Yaniv is turning vision into reality, with the launch of advanced financial tools that will complement the revolution in investment management, fundraising, and the capital market.

|

|

Biography

Yaron founded IncrediMail in 1999 (which became Perion, formerly Israel‘s largest Internet company), served as CEO of the company for more than 8 years and led it to a successful IPO on Nasdaq. Yaron is an expert in start-ups, who, over the past decade has been an investor, serves as a director and advises dozens of companies. Yaron is an enthusiastic supporter of the investment world and has tremendous entrepreneurial experience. He brings with him the vision, tools, experience and commitment to continue leading and developing ExitValley and the world of crowd investing in Israel.

|

|

Biography

Yoel lives and breathes technology and is an expert at turning ideas into reality. Yoel conceived, initiated and created ExitValley‘s technological platform, along with its groundbreaking exchange tools. Yoel leads the field of innovation and development in the company. He has more than 20 years of high-tech experience: as an entrepreneur, as a technology consultant, as an investor and as a project manager in a variety of work environments.

|

|

Biography

Nir is an experienced marketing expert who specializes in managing the full range of marketing divisions, from content to digital to PR. Nir founded the marketing department of the company, thus establishing the field of marketing for crowd investing in Israel. In addition, he designed and led the company‘s global marketing system, which established ExitValley as the most successful investment platform in Israel for four consecutive years.

|

|

Biography

Daniel is head of ExitValley‘s investments division and investors club. He has extensive experience in private equity fundraising for a variety of fields. As head of the company‘s investments division, Daniel and his team are in charge of guiding the entrepreneurs from the set-up stage, through campaign management to completion of the financing round and the legal closing.

|

|

Biography

Shai Levi manages sales and marketing for fundraising companies. She recruits companies and works in cooperation with VCs, incubators, work centers and more. Shai is responsible for ExitValley‘s close relationship with the entrepreneurial community in Israel.

|

|

Biography

Oded has extensive experience in escorting young companies and helping them reach advanced stages of their growth cycle. In cooperation with Yaron Adler, Oded founded We Group. The company advises and accompanies start-ups at all stages of recruitment and development. Oded is also a serial investor with several exits in his portfolio. His vast experience in identifying emerging trends and markets helps ExitValley to be a leading company in the field of investments.

|

|

Biography

Shai Deal is a partner in the law firm Naschitz Brandes Amir in Tel Aviv, one of the largest and leading law firms in Israel. Shai joined the firm in 2000. He specializes in corporate law, high-tech, commercial transactions, banking and intellectual property, and has been involved in many high-tech Proceedings, including private and public financing, acquisitions and technology deals. Shai‘s specific expertise is the legal aspects of crowd funding, investment platforms and peer-to-peer loans. |

|

Biography

Ben has vast experience in business development alongside his experience in the private equity sector and in managing successful fundraising rounds. As Investment campaign manager, Ben guides the entrepreneurs and the companies on their financing rounds at ExitValley, along with close guidance to Exitvalley’s investors community. Ben, a lawyer in his training, also manage the entrepreneurs relations with the investors following the fundraising rounds on the platform.

|

|

Biography

Maor has extensive experience in social business entrepreneurship, private equity sector and in managing successful fundraising rounds. As Investment campaign manager, Maor guides the entrepreneurs and the companies on their financing rounds at ExitValley, along with close guidance to Exitvalley’s investors community. In addition, Maor is responsible for collaborating with many private sector entities and is currently completing His Master‘s degree in Finance at Ben Gurion University.

|