MyleFly

156% of funding target

Highlights

Highlights

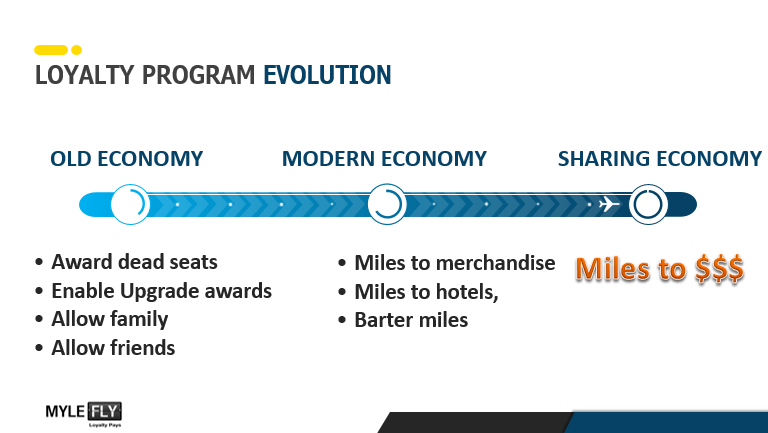

MyleFly brings the sharing economy model to the airline loyalty programs

MyleFly builds the first trading arena that lets requent flyers sell the miles they have accumulated at their various airline programs while redeeming those miles to low fare flight tickets to others. The technology behind this model optimises the miles value for the frequent flyer while calculating in real time the price for the flight ticket to assure that its price would be the lowest in the world. MyleFly joins giants such as Uber and AirBNB and brings, for the first time the revolution of sharing economy to the traditional airlines industry.

Breakthrough technology

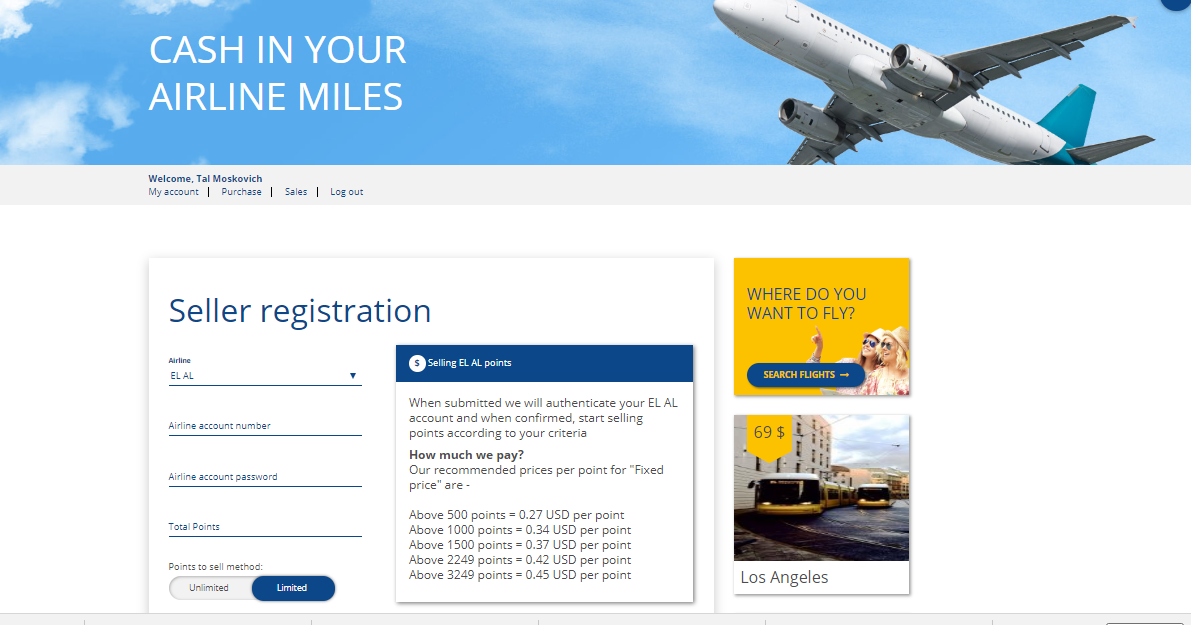

MyleFly has built a unique and sophisticated algorithm that calculated in real time the price we offer for flight tickets by analyzing and calculating different variables such as the market price of a regular paid ticket, airline taxes, availability of seats and the price per mile for the frequent flyer. Our technology is pioneered and the first and only one that automates the redeemption of miles from one individual to a flight ticket for another while optimizing the value for both in a user friendly platform and an advanced UI that provides the user experience that travellers are used to in OTAs.

Strategic partnerships with key players at the travel industry

MyleFly has signed an agreement with The Israel Association of Travel Agencies and Consultants (ITTAA) that corporates and represents 400 leading travel agencies and 4500 travel consultants in Israel. This orgranization has realized that our unique model can provide new ways to increase their revenues and decided to offer it accordingly for its members.

MyleFly at present buy miles and points of over 20 leading airlines worldwide, mostly from North America, Europe and from the leading airlines in APAC and the Golf. In addition, the company works closely with dozens of travel agencies all over the globe that provide their demand for discounted flight tickets.

Proofed business model

Following 3 years of commercial activity the company has a significant turnover substential margins. MyleFly's ability to calculate the flight ticket fare on its own using an algorithm that takes under account many parameters, optimizes the value for the frequent flyer that sell its miles, the discount that the buyer of the flight ticket receives and our own commission. The average mark up during those 3 years of activity is approximately 20% which is extrodinarry in the competitive travel industry.

Being the first at a multi billion dollars market

Airlines own their frequent flyers approxinately 400B USD however, most of those miles owned by frequent flyers are not used and expire after a pre-defined period of time. MyleFly's technology enable for the first time to effectively use those miles and points worth hundreds of billions of dollars and position the company at the front of this new market.

Pitch

Pitch

Airlines owe app $400B to their frequent flyers. This debt in their balance sheet liabilities increases at a rate of 11% annually. In order to reduce this enormous debt airlines devaluate their loyalty programs once in a while which decreases the value of each mile and reduces the chances to redeem those miles to actual product that the airlines offer on top of the limited availability that already makes it hard for the program members to redeem miles. MyleFly provides a real alternative to the frequent flyers by buying those miles from them in return for cash money while we find the demand for those miles using a global network of travel agents that have engaged with us or directly with passengers looking for low fare flight tickets. That way, MyleFly, offer supply for the lowest flight ticket fares in more than 20 leading airlines in the world. Our ability to find seats relies with the fact that the average world load factor on airlines is 82% as it spread all year long vs the frequent flyers demand which is mostly on hot seasons.

The Need

Frequent flyers accumulate airline miles through various loyalty programs. Unfortunately, they struggle to redeem those miles for award tickets and upgrades due to the low allocation of award seats (especially during high seasons) and the time limits placed on leveraging the points. In most cases, those miles expire 2-3 years after being accumulated.

MyleFly's ability to buy miles for cash lets frequent flyers receive an actual value for those miles; MyleFly converts them to low fare flight tickets for travel agencies around the world, which providing strong demand from their passengers all year long.

In recent years, frequent flyer miles have become a currency that can be used in a virtual mall operated by the airlines. Airlines are aware that the ability of most program members to redeem those miles is limited and, therefore, they add many other products as alternatives. However, the variety of products offered by the airlines is very limited as well, and the value of the miles to be redeemed for those products is much lower than the actual value of those miles when being redeemed for flight tickets and upgrades.

MyleFly has built an algorithm that optimizes the value per mile at each airline and in that way providing the frequent flyer with a value per mile that is higher in many cases than the value offered by airlines for each of their consumer products; income is, of course, received in cash money. In many cases, the value that we calculate is even higher than the value of that mile in Economy class. In the resulting scenario, even if the member plans to redeem his miles for an economy award ticket with the airline, he will get a higher value by first converting the miles to cash with MyleFly, then buying the flight ticket directly from the airline, and will still profit from that transaction.

The solution

Airlines owe approximately $400B to their frequent flyers. This debt in their balance sheet liabilities increases at a rate of 11% annually. In order to reduce this enormous debt, airlines devaluate their loyalty programs once in a while. This decrease in the value of each mile reduces the chances to redeem those miles for actual products that the airlines offer; this barrier for using those miles add up on top of the limited availability that already makes it hard for program members to redeem miles. MyleFly provides a real alternative for the frequent flyers by buying those miles from them in return for cash, while we find the demand for those miles using a global network of travel agents that have engaged with us or by engaging directly with passengers looking for low-fare flights. As such, MyleFly offers a supply of the lowest-fare tickets in more than 20 leading airlines in the world. Our ability to find seats relies on the fact that the average world load factor on airlines is 82% and spread throughout the year, versus the frequent flyers demand, which is mostly during high seasons.

From the press

The technology

MyleFly has built an advanced, unique algorithm that calculates in real time the price of flight tickets, taking into account many variables such as market price of that paid flight ticket, availability of seats for the award classes, airport taxes, the prices that the frequent flyers requested, and so on.

The technology is one of a kind in the industry; it is the only one that recommends to the frequent flyer the actual market price that the mile is worth in each airline and is based on the number of miles that the flyer possesses with each airline.

Our technology is the only one that automates the process of redeeming miles, from one individual to another individual, as a flight ticket, in a user experience that is similar to the familiar experience of regular OTA web sites.

Team

Team

|

Biography

Tamir Levi has extensive experience with complex sales, negotiation and customer service. During the past three years he has been leading the company‘s sales activities with private customers and travel agents all over the world. Tamir will lead the company to its next stage of implementing a fully automated system. |