Ooga

20% of funding target

Highlights

Highlights

A first-of-its-kind Fintech platform – One Stop Shop for business management

Ooga is the first platform in the world that provides a complete operational - financial solution for businesses. Ooga consolidates all the systems required to manage a business, such as receiving customer payments (including credit clearing), invoicing, making payments to suppliers, tax authorities and pension providers, and setting up and operating customer clubs.

Increasing economic efficiency - Significant reduction in financial costs and operating time

Ooga enable businesses to significantly reduce financial costs and time spent on financial operations, thereby allowing you to concentrate on the actual business processes: production, marketing, sales and development.

Contracts with some of Israel's leading companies - in advance of entering the international market

Ooga has already started working with some of Israel's well-known businesses. The company plans to enter the international market in 2019.

A technological breakthrough in the flourishing Fintech industry

The Fintech industry is one of the most booming industries in the world today, and as such attracts many investments - in 2017 over $ 40 billion were invested in financial technology ventures.

Ooga offers a groundbreaking product in a huge market that is constantly seeking technological innovation.

An ideal solution for small and medium businesses - the core components of any economy

Small and medium businesses are the core components of every economy (in Israel, they make up over 99% of the country's businesses). They usually bear the operational-financial burden - relatively little manpower and constantly having to deal with the banks, state institutions and credit agencies.

Ooga offers an ideal solution for freelancers and small and medium businesses - an innovative financial management platform that frees up business owners, allowing them to focus on running the business, generating revenue and growth.

Pitch

Pitch

The need

Small businesses are at the heart of every economy. The small businesses that come into daily contact with households have the complex burden of running a small business, which poses a financial, marketing and ongoing operational challenge, among other things, in dealing with significant clearing costs for the credit card companies, who bite into the profits.

The world of payments, which was born in the ninth century and actually even earlier, since people began to trade with each other in barter, has undergone a major revolution in recent years. Alongside the growth in consumer and business sources and payment systems, consumers and businesses today are looking for comfort, simplicity, and availability - without sacrificing the need for security and a fair price.

the solution

Ooga has developed a system that enables small business owners who depend on clearing systems, to clear credit card transactions and to receive payments from digital wallets, easily and at minimal cost, positioning the platform as a worthy competitor among the existing options in the market today. The user's experience lies at the center of the technological innovation offered by the system, in order to enable fast and convenient payments (FRICTIONLESS PAYMENTS).

Ooga helps the growth and prosperity of businesses that partner with it, through a unique and successful cooperation with a leading financial institution, providing a simple yet comprehensive framework for managing the business and all its financial needs.

How does it work?

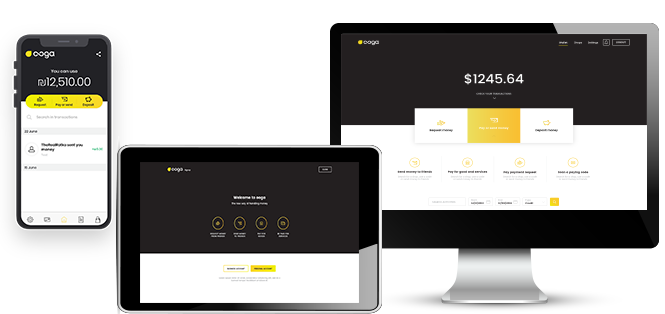

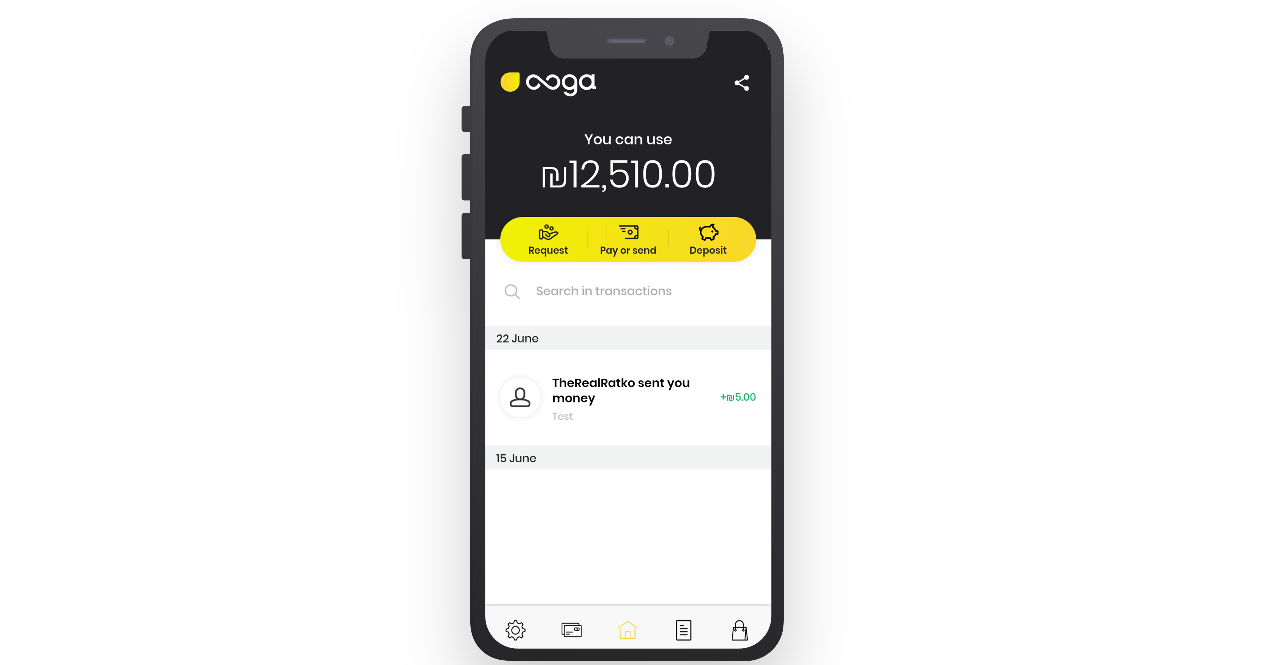

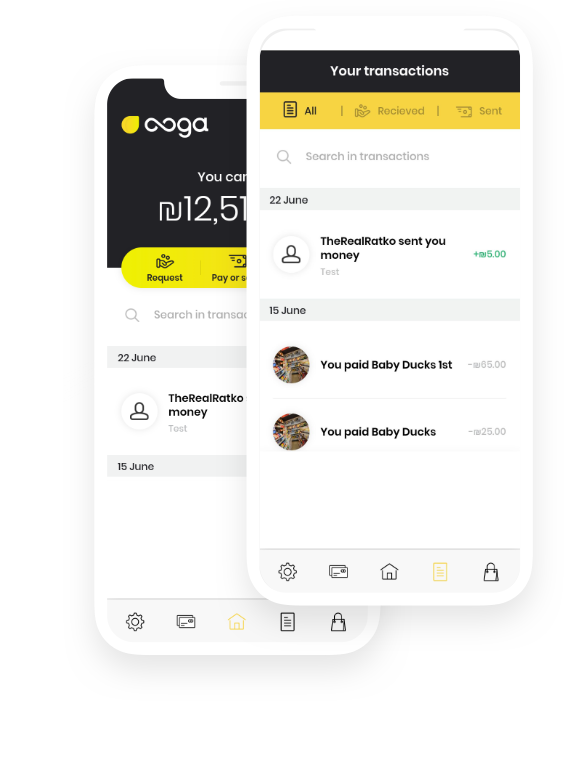

With Ooga you can pay and transfer money with your mobile phone only, using Ooga's digital wallet, to transfer money, make payments from your credit card, bank account and soon even cash, all from your mobile phone. No wallet, no ATM, no commissions, and no bank account.

The system works with all types of bank and credit card accounts, and meets every need, from a supermarket or store payment, to making various types of payments.

The system also allows consumers to make payments from their credit card, bank account and even cash - all from a unique payment application installed on the mobile phone.

Ooga Wallet - The digital wallet that allows everyone to forget their wallet and transfer money, make payments and purchases, using only the smartphone.

Ooga Pay - A friendly digital platform which enables business owners to clear credit cards, make payments to suppliers etc. All using a smartphone or a PC, easily and at a minimal cost.

Among the services offered by Ooga:

- Online Register - a smart and advanced register, which can be operated via any device: smartphone, PC or tablet. It offers an extensive solution for the sale process and includes smart tools for managing the business.

- Credit card clearing - meet the new generation of credit card clearing, from the PC, smartphone or tablet.

- Suppliers payment system - a friendly and easy interface for businesses who use Ooga's credit card clearing or payment services. It allows using the money accumulated to pay suppliers, make recurring payments or transfer it to a bank account.

- Consumer Clubs - Ooga's speciality is in forming highly effective "consumer clubs", starting from marketing advice, hands-on operational training, embedding the interface into registers, defining savings sales, marketing communications and reports.

Concept and vision

Ooga is an innovative digital platform for transferring and receiving payments via credit, cash or bank transfer, easily, quickly and at minimal cost. Ooga addresses the SME market, which accounts for 99% of the business market in Israel, allows saving on commissions and enables, among other things, receiving payments from customers through various means of payment, as well as making one-time or recurring payments to suppliers. Subject to regulatory approvals, Ooga aims to expand its range of products and services available to business customers in Israel, to allow them a complete solution to all the financial needs of the business through Ooga.

Ooga believes that the Israeli business community deserves a set of financial products and services that will be accessible, convenient and fair. Since none of the banks in Israel provide a system that meets these requirements, the company has decided to set up such a platform for the benefit of the entire business owners community in Israel and their customers.

The management of finance and banking has become exhausting for small business owners. It does not have to be that way. There are places in the world where banks, for all their financial expertise, are the most important tool for entrepreneurs. They do not cause anxiety, overload the business owners, or take many hours of work. They act as partners to help independent entrepreneurs, companies and new businesses to establish themselves.

An examination conducted by the company with many business owners in Israel shows that, for most banks in Israel, there has been erosion in these relationships with small and medium-sized business owners. Along with expensive and polished marketing campaigns, business owners encounter an uncomfortable, expensive and even unfair policy in their ongoing relationship with their accompanying bank.

Ooga's goal is to eliminate the difficulties and excessive costs of banking and financial management services for start-ups and small businesses. The Company invests great efforts in establishing an advanced and unique array of financial products and services for the benefit of the business community in Israel.

Ooga strives to be the first line of defense available to its customers against the burden of financial management and banking. The enthusiasm and dedication of the company and its leaders for this purpose are reflected in every aspect, from the business model, technology and design, to the company's business culture.

Ooga's team consists of banking experts, experienced entrepreneurs, engineers and designers who are eager to help businesses thrive by creating the world's most efficient business banking experience. Ooga invites you, the potential clients of the venture, to assist in its establishment and financing, and to be partners in the forming of a community initiative that will serve the entire business community in Israel.

Business model

In the first stage, the platform will be launched at no cost to consumers (who make payment) and at a low cost to merchants who receive payments through it.

These businesses currently pay 1-2% fee to the credit card companies (depending on the size of the business and the type of activity), while Ooga will collect only 0.5% for payments made to its digital wallets, on its way to holding a significant market share in this market.

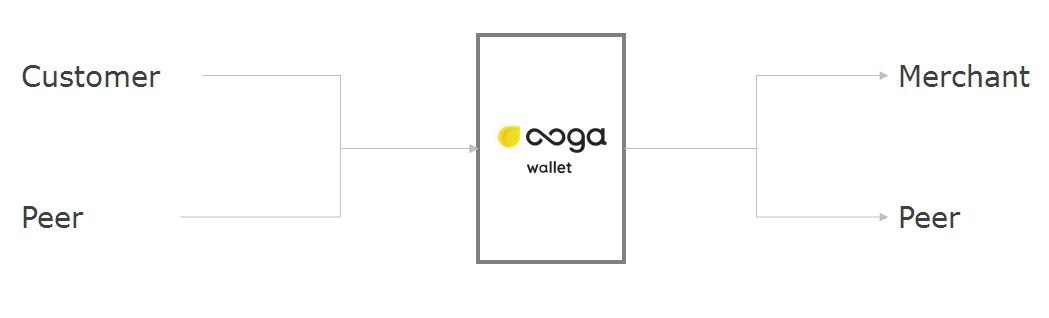

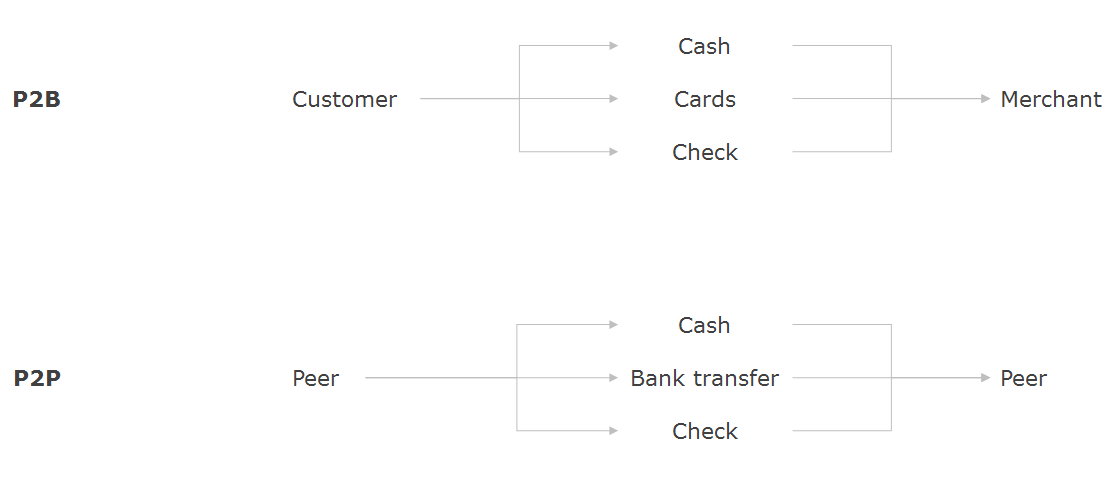

The company will work both in P2B and P2P:

Team

Team

|

Menny was the CEO of Wayerz, a company he founded in 2014. Under his leadership, Wayerz was selected into the 2015 Barclays Accelerator program in New York, and honored at the Shengjing Global Innovation Awards.

Prior to launching Wayerz, Menny founded and led Mipso, an SaaS-based virtual fitting room and styling platform for fashion brands and retailers. Shalom led all online and mobile product management and development teams, in addition to raising more than $5M in funding.

Menny previously founded and served as CEO Medifreeze a global cryo-preservation venture, from 2004-2009.

In 2003, Shalom received a Master’s degree in banking and finance from The Hebrew University of Jerusalem, where he also graduated with honors, receiving a bachelor’s degree in law and accountancy. He received a Master’s of Law from Columbia University School of Law, graduating with honors in 2000.

|

|

Aviv Alexander has a demonstrated history of working in the Information Technology Services industry. Skilled in a number of different programming paradigms, languages, frameworks and specializing in full-stack and mobile solutions; Alexander has hands-on technical experience as well as active business development leading small to large IT teams and consulting for firms of all sizes.

Aviv is a top performer in technology and development. He lead large nearshore and offshore development team and is skilled to lead our tech team. |

|

Igal is a polyglot executive (Spanish, English, French, Portuguese and Hebrew) with 20+ years of experience in technology and startups. Igal Chemerinski currently Heads EMEA & LATAM business development activities for VOTIRO. Prior to VOTIRO, Igal served as VP Sales and CMO at Wayerz, On-Premise / SaaS integrated software platform for banks.He has led Sales, Business Development and marketing initiatives at a variety of technology startup and public companies. Igal holds an MBA from the University of Toronto, and a B.sc from the University of Florida.

|

|

Gadi is an experienced consultant on setting up and managing server farms, communication and security infrastructures of leading institutions and organizations in Israel. For more than 20 years, he has been providing consulting and services to leading institutions in the field of advanced storage infrastructures, inter-organizational information systems, Internet and server communications, advanced cloud services and advanced security services for large organizations.

|